Any parents who are leaving assets to their children shouldn’t be too worried about any resulting Inheritance Tax bill…or should they?

Who’s hard earned assets will be sold in order to pay the Inheritance Tax? Are you happy with potentially 1/3 of your assets going to Revenue after you die? Would you like to have greater control of how your assets are split after you die?

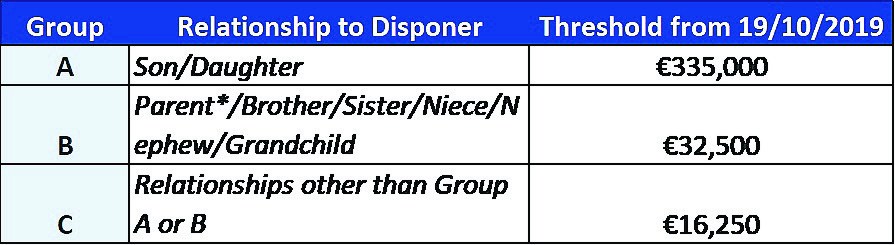

A 2018 Survey conducted by Coyne Research indicated a very low awareness of Inheritance Tax rates & thresholds. Only 1 in 6 of those surveyed were aware of what the current Inheritance tax rate is and the vast majority were not aware of the different thresholds depending on the recipient. If most people are unaware of this tax then they are unlikely to have a plan in place to address it. (For those who aren’t aware, the current rate for Inheritance Tax is 33%. The exemption thresholds can bee see in the attached Table)

There are a number of steps that can be taken in advance to help mitigate any potential Inheritance Tax bill:

Firstly, make a will. Anyone who owns a property or has an asset such as a savings plan or deposit account should make a will. Not only does a will ensure that you distribute your wealth/assets as you wish but it also means that your family and beneficiaries are spared the expense and distress of a complicated and drawn-out administration of your estate.

Another way to avoid a potentially large inheritance tax bill is by drip feeding the Inheritance by utilising the annual small gift exemption. Tax legislation allows for an annual exemption for the first €3,000 of any gift taken by a beneficiary from any one donor. This means that a beneficiary can receive up to €3,000 tax free in any one year from any donor, or even multiple donors.

One practical application of this is where parents, grandparents, aunts and uncles gift money to children. Each adult can gift each child up to €3,000 in any year with no tax liability for the child and without reducing the amount the child can ultimately inherit tax free.

It should be remembered that Gift Tax is a self-assessment tax. The obligation to make a return to the Revenue Commissioners rests with the person who receives the gift. An Inheritance Tax/Gift Tax Return must be filed when a gift either by itself or when aggregated with prior gifts exceeds 80% of the appropriate tax-free threshold amount. This reporting rule does not apply to the annual small gift exemption.

Another planning tool is to put in place a Section 72 life assurance policy. This is a specific type of policy which pays out on the second death of the parents. Section 72 of Capital Acquisitions Tax Consolidation Act 2003 states that the proceeds of this type of policy are exempt from tax, as long as those proceeds are used to pay the inheritance tax that arises on death. If you are considering a Section 72 policy, I would advise you to put it in place well before the maximum age of entry which is normally at age 75.

Gift your assets while you are still alive. You may want your Adult children to benefit from their wealth today, when they need it most. This may be better than them waiting for an Inheritance on death, this may come long after the children start families of their own. If adopting this strategy then you need to familiarise yourself with the tax free thresholds in the attached table.

It is possible for a parent to take out a Section 73 Savings Plan for a minimum of 8 years and use the proceeds to pay some or all of the gift tax that might arise when they transfer an asset to a child. If the owner of the Section 73 Savings plan dies within an 8 year period the value of the plan will not qualify to be used against either gift or inheritance tax.

In order to qualify for Section 73 relief the policyholder covered must be the person paying the premium. Only married couples or registered civil partners can execute a joint life plan. Regular premium payments must be made for at least an eight-year period.

Those who have worked hard to accumulate wealth during their lifetime understandably feel strongly about protecting it, they want future generations to enjoy it also, this is why Tax is such an important Issue for them.

Exactly how much tax is paid on death will depend on how much advance planning is undertaken. Although it may be seen as uncomfortable and uncouth to discuss topics such as wealth and dying, it is important to have these conversations now in order to avoid a potential tax bill in the future.

Barry Kerr CFP® is Founder & Managing Director of Wealthwise Financial Planning who are based in Carrick-on-Shannon and Galway. All details and views contained within this article are for informational purposes only and does not constitute advice. Wealthwise Financial Planning makes no representations as to the accuracy, completeness or suitability of any information and will not be liable for any errors, omissions or any losses arising from its use. Wealthwise Financial Ltd T/A Wealthwise Financial Planning is Regulated by the central Bank of Ireland #CI6614

Subscribe or register today to discover more from DonegalLive.ie

Buy the e-paper of the Donegal Democrat, Donegal People's Press, Donegal Post and Inish Times here for instant access to Donegal's premier news titles.

Keep up with the latest news from Donegal with our daily newsletter featuring the most important stories of the day delivered to your inbox every evening at 5pm.